Is Allowance Taxable in Malaysia

Web House Rent Allowance HRA is an added benefit that is offered by an employer to its employees. Official website links end with govsg.

10 Payslip Template Word Excel Pdf Templates Payroll Payroll Template Excel Templates

This is simply.

. In Malaysia both a branch and a subsidiary are generally subject to the same tax filing and payment obligations. Web However the annual allowance imposes a limit on the level of contributions that may be made tax efficiently. Process a pay run or click a past pay run that requires filing.

The amount that one gets as LTA differs with the employer and the position of. Any per diem allowance in excess of these acceptable rates are taxable. If you are staying in a rented house and getting House Rent Allowance as a part of your salary you can claim for fullpartial HRA exemption as per the Section 10 of IT Act.

UK tax residents than is required by HMRC. Thats why you need to be aware of which parts of your income is taxable or exempt. However the schemes own rules might restrict membership to a narrower class eg.

One of these deductions is the capital allowances in Malaysia. Web In the Payroll menu select Pay employees. Web 2022 Acceptable Rates published by IRAS for per diem allowance for countries starting with letters from G to O.

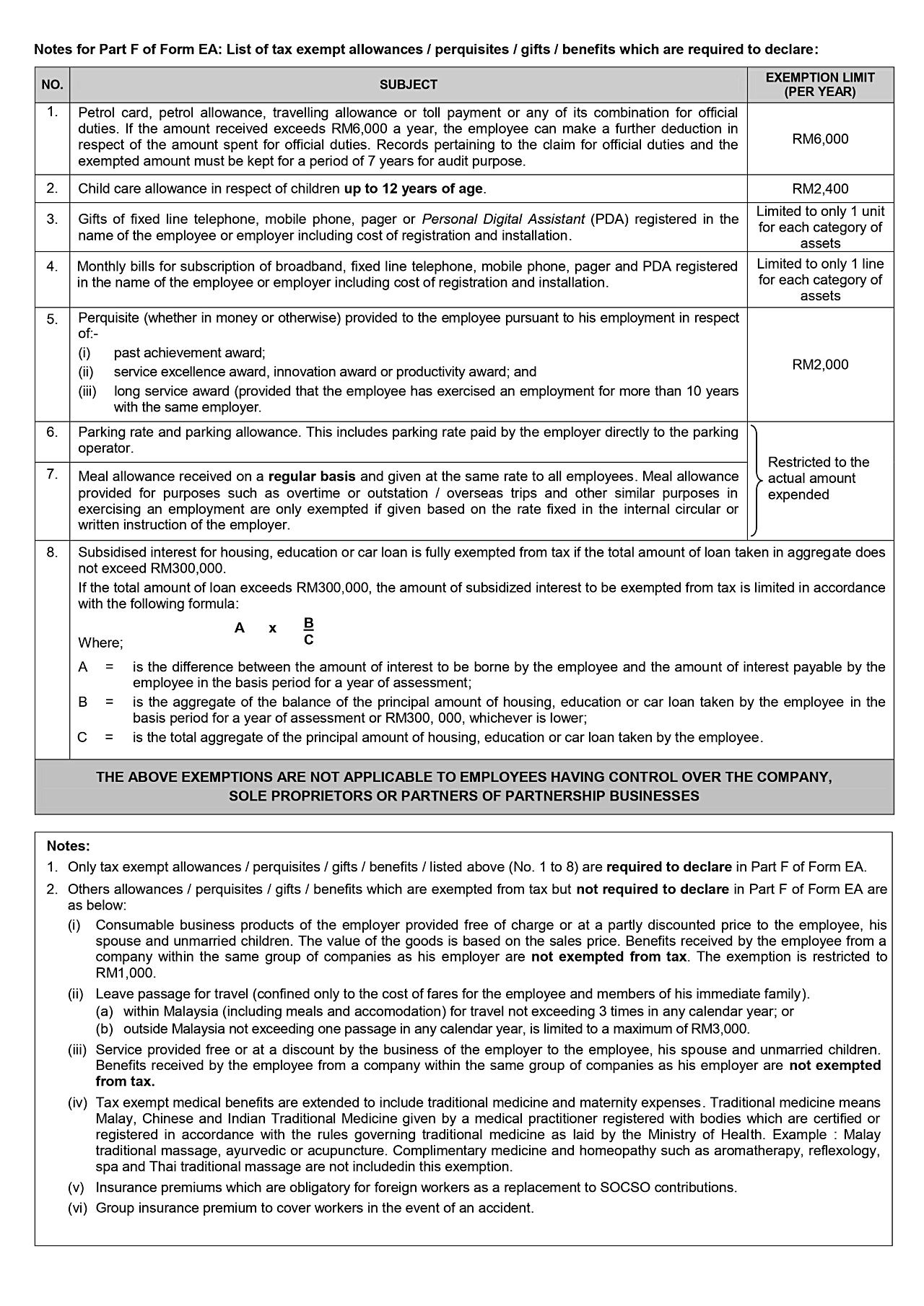

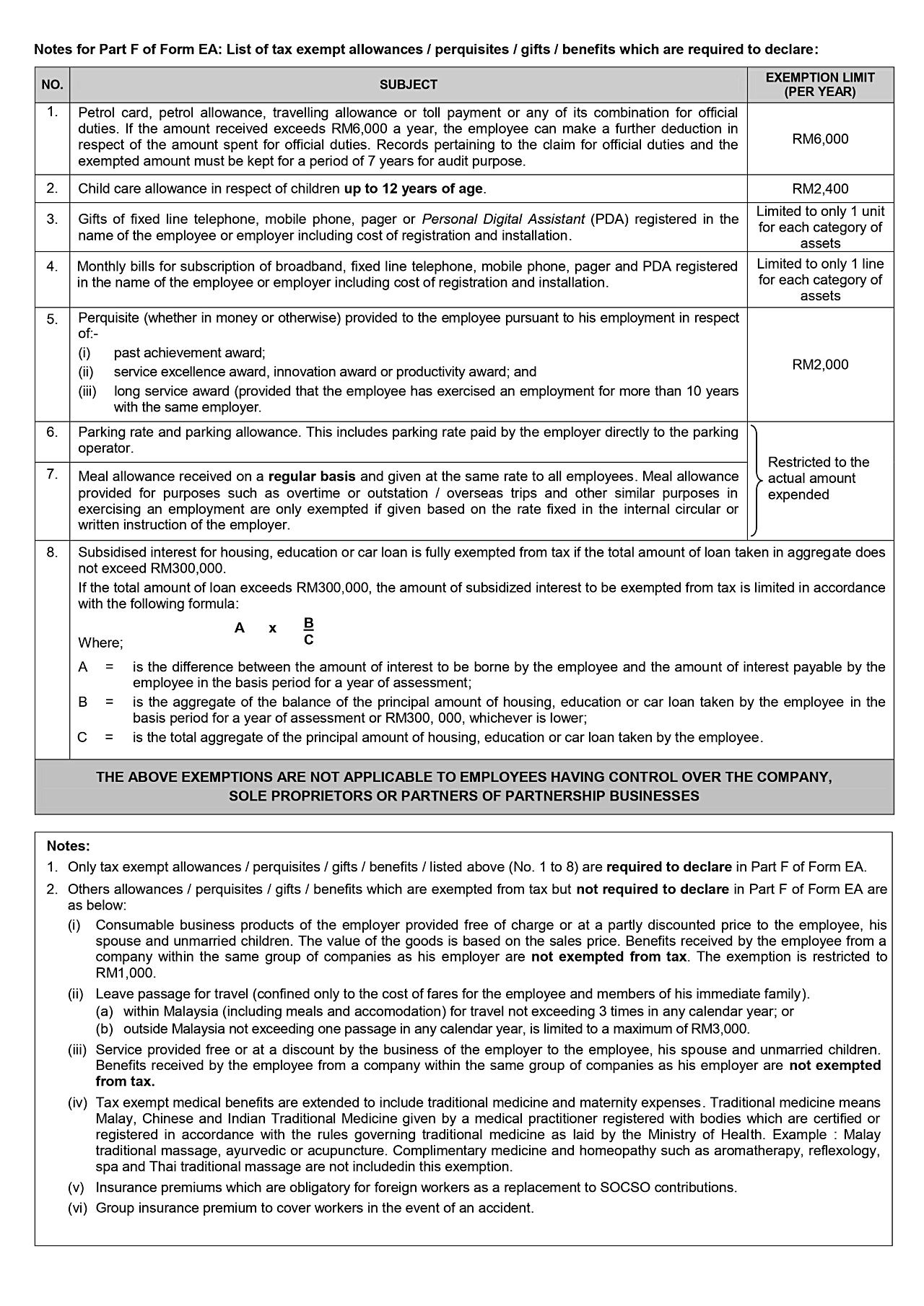

Perquisites are taxable under paragraph. This is simply. Perquisite whether in money or otherwise provided to the employee pursuant to his employment in respect of- i past achievement award.

3 per annum on a straight-line basis on structures and buildings not used in a residential capacity. Loss of personal allowance occurs where income exceeds 100000 and for people claiming the remittance basis as the personal allowance summary explains. Not all have been ratified however and not all are comprehensive Local branch.

Web Malaysia operates on a self-assessment system when it comes to income tax so the taxpayer is responsible for calculating their own chargeable income and payable tax. A Singapore Government Agency Website How to identify. As an experienced Cleantech Energy solutions provider we provide turnkey solutions and services for solar PV system.

This means that if you are aware of a 2022 tax exemption or 2022 tax allowance in Malaysia that you are entitled too BUT it isnt listed here that we dont allow for it in this version of the Malaysia Salary Calculator. Structures and buildings allowances SBAs. Web In the section we publish all 2022 tax rates and thresholds used within the 2022 Malaysia Salary Calculator.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. A person who is UK national can obtain the UK allowance wherever resident. Web The Leave Travel Allowance is the allowance provided by an employer to its employees for traveling.

100 first-year allowances in respect of assets including buildings used to carry out qualifying RD. Employers contributions do not. This is the.

Limited to only 1 line for each category of assets 5. Non-UK residents may participate in a UK-registered pension scheme. Select the checkbox to.

However to get the reimbursement the employer needs to provide the actual bills to hisher employer. Government agencies communicate via govsg websites eg. Web In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

Web In the section we publish all 2021 tax rates and thresholds used within the 2021 Malaysia Salary Calculator. Ii service excellence award. This allowance can be utilized while going on a vacation with family or alone.

Hopefully this article has helped highlight some tax exemptions you werent aware of. Web Progressture Solar is an experienced Cleantech Energy Solutions Provider in Malaysia that aspires to green South East Asias power infrastructure as it progresses towards a net-zero emissions scenario. 19 November 2019 42 Perquisites are benefits in cash or in kind which are convertible into money received by an employee from his employer or from third parties in respect of having or exercising an employment.

Web As in any regular taxation individuals and businesses can claim allowable deductions from their taxable income. Where an employee receives a fixed allowance for telephone the full amount of the telephone allowance is taxable. On the other hand HRA is taxable if you are unable to provide a proof of.

Web Note that there is a temporary 50 first-year allowance see below. However the salaries tax can be potentially mitigated in most circumstances in case the. Any posted pay runs that arent filed and have a past due date show as OverdueYou can see the filing status of a pay run under the STP filing column.

Capital allowances specifically are capital purchases like the acquisition of land and building that can be claimed as tax deductions. Web INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Web Malaysia has concluded agreements for the avoidance of double taxation agreements with an extensive number of countries.

If prompted add types to allowance pay items in your pay run. This means that if you are aware of a 2021 tax exemption or 2021 tax allowance in Malaysia that you are entitled too BUT it isnt listed here that we dont allow for it in this version of the Malaysia Salary Calculator. Web A person who is resident in the UK is entitled to a personal allowance regardless of their nationality.

Web Housing benefits received by directorsemployees from employers or the employers affiliated corporations are generally subject to salaries tax in Hong Kong unless an offshoreexemption claim on their directors feesemployment income can be satisfied.

Tax Exemptions What Part Of Your Income Is Taxable

到底几时要报税 2017年income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

Get Our Sample Of Salary Payment Slip Template For Free Excel Templates Templates Slip

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Comments

Post a Comment